Automatic break deductions

Last updated - Apr 01, 2022 at 11:35AM

Unpaid break deductions can be automatically applied when exporting timesheet data using one of the following methods below:

1. Exporting timesheets to payroll

If the payroll software file format is compatible, a Break Deductions box will be visible above the Export button at the bottom of the page. Select your desired rules before clicking the Export button.

Take me there2. Custom CSV export

If you've selected the Paired or Daily aggregate option, a Break Deductions box will be visible above the Export to CSV button at the bottom of the page. Select your desired rules before clicking the Export to CSV button.

Take me there

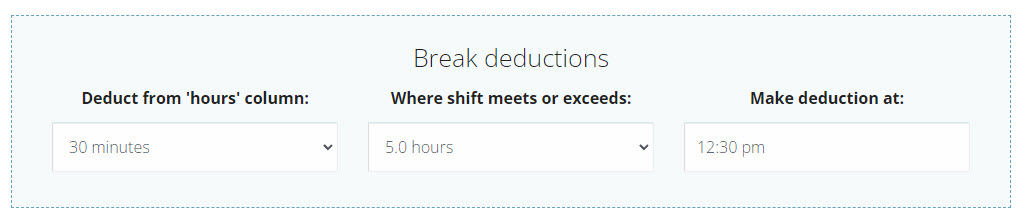

| Setting | Description | Selection Options |

| Deduct time | Select a length of time to deduct from employee hours. | Increments of 5 minutes up to a maximum of 60 minutes. |

| Where shift meets or exceeds | Apply the deduction only where the employee shift meets or exceeds a certain number of hours. | Increments of 0.5 hours up to a maximum of 12 hours, or any length of time. |

| Make deduction at | Apply the deduction at a certain time of the employee shift. If the employee did not work over this time, the deduction will not be applied. If the employee finished work within the duration after the deduction time, a partial break will be deducted from the deduction time to shift end time. | Any time of day. Leave blank to apply the deduction regardless of the times that the employee shift was worked. |

Frequently asked questions about break deductions

Can I have different break deduction amounts for different people?

When exporting data, as a payroll export or a custom CSV file, you can define a break deduction period for specific departments as you export them. We will ultimately allow for employee-specific or department-based break deductions on the live timesheets, however as at December 2023 deductions can only be applied when exporting the hours.